Well-Identified User

- #13

We reduced excessive money to your my bond to the stage where I basically reduced the load matter, thus in lieu of leaving the cash regarding the thread We withdrew several of they and you may place it into the a fund field account. Therefore, lets say my bond is R1 000 000 I had R1 030 000 regarding availableness bond. We grabbed aside R25 000, and so i nonetheless was basically along the loan amount by the R5000, meaning I do not are obligated to pay something. You know what my personal monthly debit buy ran up. Thus i thought its odd because there is zero appeal speed raise otherwise anything therefore simply went right up throughout the R200. Next month my debit purchase went from as per normal and you can I experienced a whole lot more an excessive amount of money regarding thread. Therefore i grabbed out extra money, maybe not my thread try Roentgen-5000 below what i owe them. Again new monthly payment ran upwards. We phoned the house loan department as well as they could perhaps not know it and you may said they are going to return to me, it never performed. The following month the same techniques, got the money aside adopting the debit order and you will debit order went right up again. Perhaps not I was for the excessive once more, thus my house is totally paid down but I am investing a lot more monthly.

Academic

Ultimately bought them again and requested all of them once more in the the develops, as the each time I just take money aside normally not even below the bond amount I must pay a great deal more, https://paydayloanalabama.com/camp-hill/ step 3 increases consecutively but generally I do not owe them something they are obligated to pay myself. Lond tale short, why I’d is the fact any time you shell out money into or take money away it recalculate the load with the level of weeks kept towards identity. So their tale goes that you may end up being investing indeed to absolutely nothing per month to meet up the conclusion title big date, assuming either you you take money out, place money in or perhaps the interest changes the text gets recalculated to be certain towards the end of your own term you would owe nothing.

They however doesn’t make sense in my experience but I nearly worn out all the avenues to acquire an explanation that produces feel. Once the how do i be investing a lack of after good attract speed boost, and today they need to to improve it but I actually do not are obligated to pay things as soon as. They told you the same manage happen should your interest rate changes as well as generally rectify this new month-to-month debit buy to meet up the brand new stop out-of name date, so essentially the quantity the debit purchase rises otherwise down considering interest % is not completely according to research by the debit acquisition % transform.

Your almost certainly decided to go on paying the bond as if that you do not overpaid. Hence, even though the bond are paid-up new monthly payment try calculated as if you will still be expenses it well on the identity of one’s thread. The positive would be the fact their monthly payments are part of their equilibrium, therefore no money is lost and you can grab they out once again.

If you do not would like to get troubled such as this, then love to get money recalculated any time you more than shell out to your thread.

If perhaps the fresh lump sum payment readily available following come in and just have which remedied that have Standard bank since some thing is actually upwards otherwise your own site since the normal cost are completely wrong.

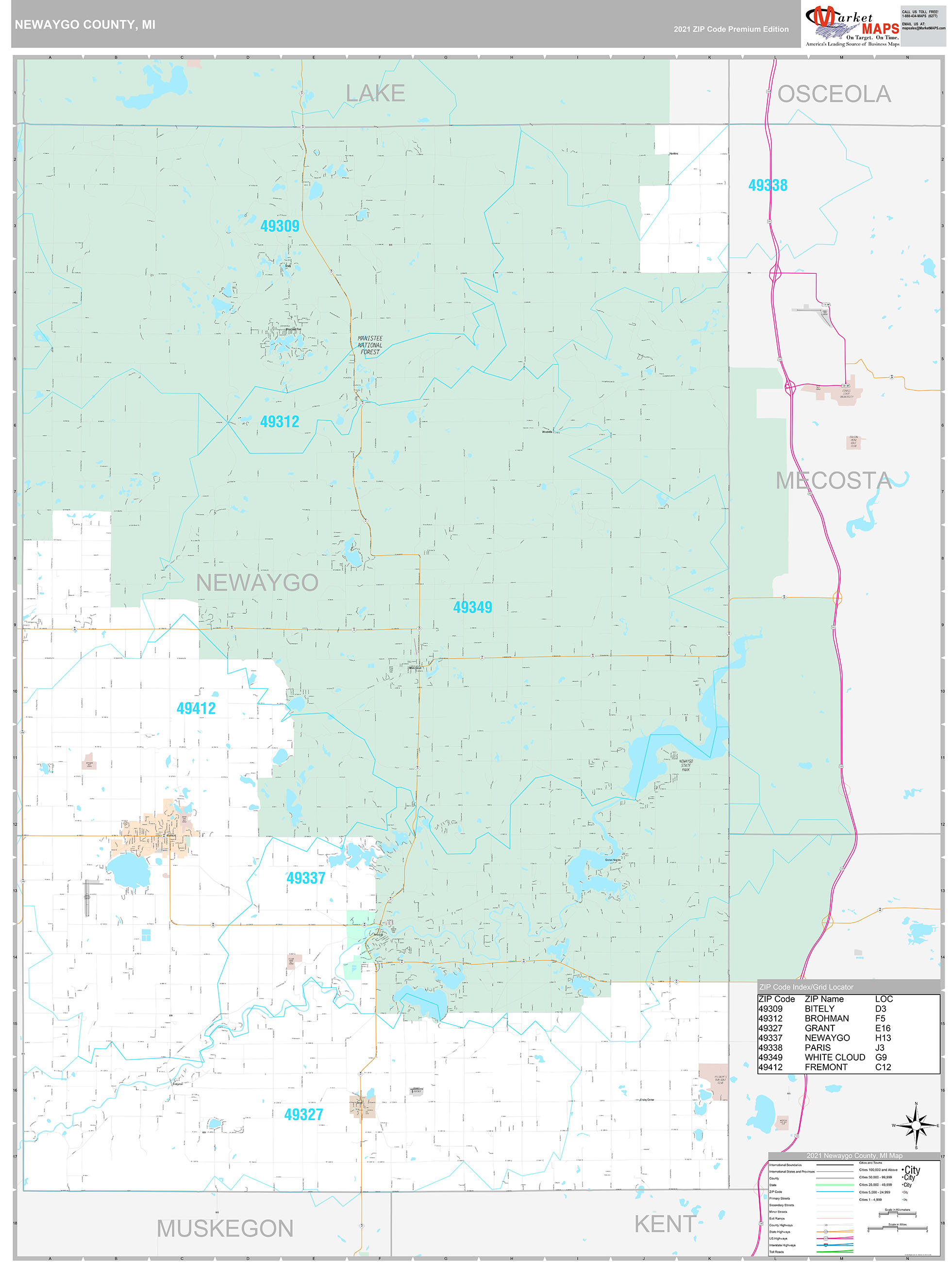

The audience is still arguing the brand new fairness with the obscure text which have Basic Bank in addition to undeniable fact that every-where the brand new access thread was explained written down (webpages, banking app), this new wording made use of indicates zero change in brand new month-to-month payment unless of course the interest rate alter (discover visualize here).