Transferred-in costs are incurred in a different department during a process completed by that department. If those costs weren’t 100% complete, the product wouldn’t have been transferred out of that department! If you recognize this, you can simplify your transferred-in cost calculations somewhat.

Inventory analytics dashboard

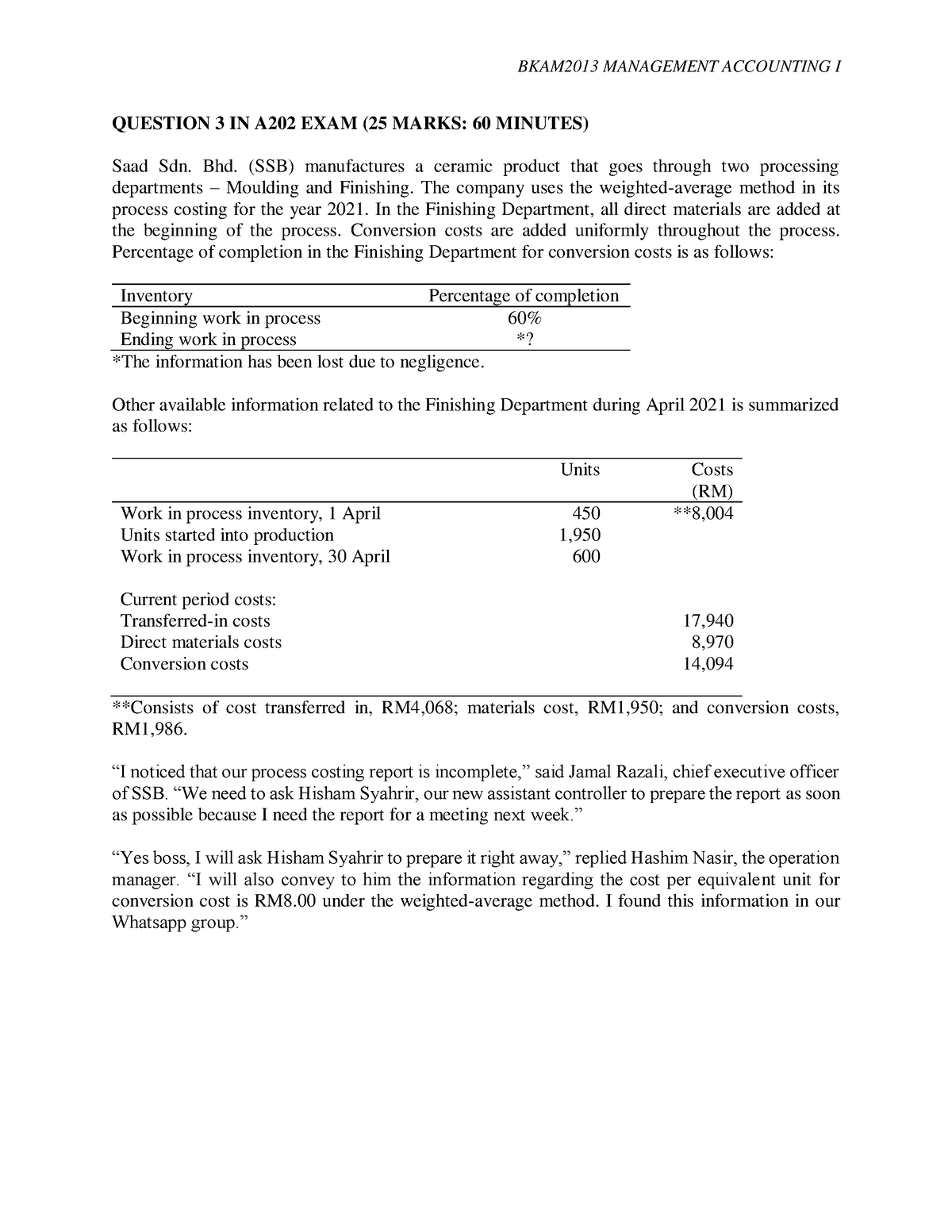

Preliminary figures show current year net income before taxes totaling $1,970,000, which is short of the target by $30,000. The president approaches you and asks you to increase the percentage of completion for the 40,000 units in ending WIP inventory to 90 percent for direct materials and to 95 percent for direct labor and overhead. For example, forty units that are \(25\%\) complete would be ten (\(40 × 25\%\)) units that are totally complete. Hershey likely uses a process costing system since it produces identical units of product in batches employing a consistent process. Process costing systems require the use of work-in-process inventory accounts for each process.

Accounting for WIP inventory in the balance sheet

Summarize the costs to be accounted for (separated into direct materials, direct labor, and overhead). Work in process begins with the first stage of production (mixing and blending), continues with the second stage (bottling), and ends with the third stage (inspecting, labeling, and packaging). When products have gone through all three stages of production, they are shipped to a warehouse, and the costs are entered into finished goods inventory. Once products are delivered to retail stores, product costs are transferred from finished goods inventory to cost of goods sold. A product may be manufactured through one process or more than one process.

Work in Process Inventory – What Is WIP and How To Calculate it?

- Understandably, all companies need to be focused on their cash flow and overall financial health.

- Otherwise, the ending WIP must be calculated manually by looking up all incurred costs for the unfinished production, or by using standard costs based on the stage of the goods’ completion.

- Although rounding differences still may occur, this will minimize the size of rounding errors when attempting to reconcile costs to be accounted for (step 2) with costs accounted for (step 4).

- Figure 3.6 “Calculation of the Cost per Equivalent Unit for Desk Products’ Assembly Department” presents the cost per equivalent unit calculation for Desk Products’ Assembly department.

- The following information is for the Mixing department for the month of March.

This excludes the value of raw materials not yet incorporated into an item for sale. The WIP figure also excludes the value of finished products being held as inventory in anticipation of future sales. First, FIFO only applies this period‘s rate to work done this period. So, the beginning WIP equivalent units are subtracted away in order to arrive at “Equivalent units completed with this period’s work” (see cells E4, E11, and E18). That removes the portion of beginning WIP units that were completed last period. If you sum the three ending WIP products above, you have the total cost of ending WIP.

1.2 Complication #1: Units in Ending WIP Inventory

For example, it would be impossible for David and William to trace the exact amount of eggs in each chocolate chip cookie. It is also impossible to trace the exact amount of hickory in a drumstick. Even two sticks made sequentially may have different weights because the wood varies in density. These types of manufacturing are optimal for the process cost system. Understanding the company’s organization is an important first step in any costing system. The sticks are dried, and then sent to the packaging department, where the sticks are embossed with the Rock City Percussion logo, inspected, paired, packaged, and shipped to retail outlets such as Guitar Center.

How Is Work-in-Progress Calculated?

Companies often try to limit what is reported as unfinished because it is difficult to estimate the percentage of completion for works in progress. Work-in-progress sometimes is used interchangeably with work-in-process, but work-in-progress typically refers to more time-consuming projects, such as construction. Work-in-process typically refers to goods that are manufactured relatively quickly. WIP is a concept used to describe the flow of manufacturing costs from one area of production to the next, and the balance in WIP represents all production costs incurred for partially completed goods. Production costs include raw materials, labor used in making goods, and allocated overhead.

In this chapter, you will learn when and why process costing is used. You’ll also learn the concepts of conversion costs and equivalent units of production and how to use these for calculating the unit and total cost of items produced using a process costing system. We calculate this by dividing the total cost by equivalent completed units in the production phase. The cost per unit calculated here reflects the cost of only completed units.

Add that $860 to whatever we figured was the conversion cost of Units Started and Completed and we have the total conversion costs of units completed and transferred out. Process costing firms usually have several departments that products must pass through before they’re complete. For responsibility accounting purposes these departments costs should be kept separate. So each department allocates costs at the end of the period to reflect the units that department completed and transferred onward to the next department. The production manager is told to push his employees to get as far as possible with production, thereby increasing the percentage of completion for ending WIP inventory.

Figure 3.5 “Summary of Costs to Be Accounted for in Desk Products’ Assembly Department” shows that costs totaling $386,000 must be assigned to (1) completed units transferred out and (2) units in ending WIP inventory. Basic resources are rolled into a factory, followed by loud noises and a smoking chimney. On their journey toward becoming final products, raw materials go through work in process inventory. Work in process (WIP) inventory is a term used to refer to partly finished materials within any production round.

Now you can determine the cost of the units transferred out and the cost of the units still in process in the shaping department. In production and supply-chain management, the term work-in-progress (WIP) describes partially finished nonqualified deferred compensation plan faqs for employers goods awaiting completion. WIP refers to the raw materials, labor, and overhead costs incurred for products that are at various stages of the production process. WIP is a component of the inventory asset account on the balance sheet.