Nine Financing Options for a split up

Divorce proceedings is actually psychologically tough adequate without having to deal with a difficult partner who has got reduce your regarding economically otherwise a posture the place you only don’t have the resources to cover an enthusiastic fair broke up on account of online game to try out otherwise postponing. Unfortuitously, there is no free food one to finances a divorce process; yet not, financial support will save you a great deal in the long run when the property are hidden or the other hand isnt impending which have advice and you will finance are necessary to hire a beneficial attorneys, perhaps a CDFA, a forensics individual or resource is necessary toward members of the family when you look at the process.

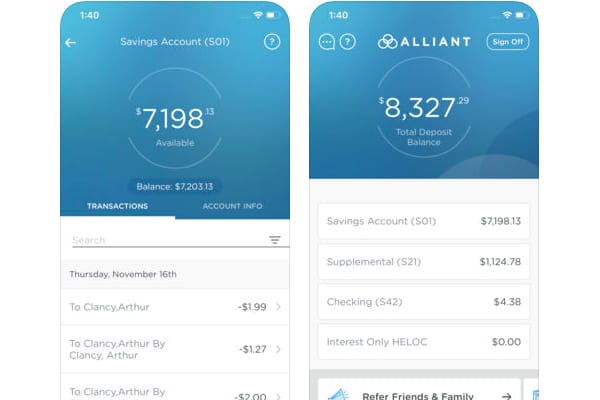

step 1. Family security personal line of credit Property security credit line (HELOC) allows you to borrow secured on the new guarantee of your home always at the a variable interest rate more an appartment time period, along with home prices highest immediately, lots of people are trying to find guarantee within this investment classification.

A court could even acquisition parties to get security from a beneficial family in order to buy interim help and legal fees up to a separation and divorce try finally. HELOC acceptance could also bring week to accept and you can loan providers you are going to perhaps not approve applicants through the a split up, which will lead to multiple roadblocks to a divorce case.

2. 401K Mortgage These loans routinely have straight down interest rates than an unsecured loan and do not get said toward credit reporting agencies, yet not, you may need spousal recognition to take out good 401K loan. Your wife get commit to allow mortgage so long as they reduces your internet part of the house split up and will maybe not slow down the full ple, 401K worth in the $100,000, $20,000 401K financing payable by personnel spouse, each party gets $50,000 about settlement, but wife’s portion is really web $30,000 = $fifty,000 marital interest in 401K – $20,000 loan harmony.

Bear in mind, the fresh new Irs need you to pay-off the remainder financing equilibrium in this 60 days regarding making an employer or even the mortgage would-be thought a delivery. There is certainly tax and you will punishment owed if you’re unable to pay where time period.

3. Personal loan Acceptance is dependent upon your credit rating, present a fantastic debt burden (obligations so you’re able to earnings ratio) and you may capability to pay off.

4. Securities-founded personal lines of credit -allows you to borrow funds and borrow secured on the significance of the investment profile always which have an adjustable rate of interest. This is usually utilized for what would be considered brief investment and you can put once the a connection anywhere between 2 changes – perhaps even processing and paying down a separation. Its a technique you to definitely suppresses needing to sell bonds and you can taking on money increases taxes to help you so you can raise cash having a need.

But not, debtor beware, a safety-situated credit line out of a lender are subject to a good higher degree of chance, while the bank can get request quick cost of one’s outstanding equilibrium otherwise require extra bucks otherwise securities to-be bound if for example the market goes down and you may root ties one to ensure the line of borrowing from the bank are now really worth shorter.

5. Life time Insurance coverage financing -You can take a tax-100 % free financing and acquire regarding the available bucks really worth out-of a good very existence plan. These types of normally have lower rates of interest than just a consumer loan, do not get advertised toward credit agencies and you can build smaller appeal merely mortgage payments. A drawback usually the latest demise benefit left on the beneficiaries at your passing, could well be reduced from the people the loan balance nonetheless owed.

six. Attorneys preparations Maybe you may have a plan together with your lawyer that may allow the fees are paid down of property following settlement (perhaps regarding a pension investment) or create monthly payments plus attention through to the balance was paid down out of. Once more, zero borrowing from the bank agency reporting, and i be aware regarding associates that have over one another choices. Yet not, I would assume this might be more difficult to arrange, as attorney commonly on the currency financing organization, as a general rule.

seven. Handmade cards Strategically seeking the best in order to give the expense out of fees round the numerous cards and never surpassing the financing application maximum of 31% with the anyone credit because of the excessive, whenever possible can be helpful. Thought splitting up get on your own upcoming? Today is the big date, when you’re still marred, to consider opening an alternate cards or several, and/or have your constraints increased. Each other choices is likewise difficult for individuals with a minimal credit rating, therefore begin boosting that credit rating today!

8. Divorce proceedings Financial support organizations – Contrary to popular belief you’ll find companies that specialize in split up capital. In place of a lender or finance company, money enterprises evaluate capital qualification according to research by the requested payment out-of a buyer’s divorce or separation proceeds perhaps not latest property, earnings, or credit rating.

Generally, no cash flow from through to the settlement try final, no mortgages try started this new buyer’s possessions. However, just how one influences brand new revealing on your own borrowing agency history otherwise credit history. I am not sure.- Find Such step 3 individuals will money your own separation and divorce. Keep in mind that terminology may differ from bringing a share of one’s payment, billing an interest rate, otherwise getting a monthly fee in addition to balance at the settlement.

Nine Capital Choices for a separation

9. Legal ordered charges -The newest moneyed companion might possibly be purchased by the legal to invest both sides from courtroom fees and pro rates, however, despite processing moves, this will be a pricey and you will date-drinking procedure.

If you are contemplating divorce, this may sound right to consider no less than one ones locations thereby applying beforehand. For those who have currently filed to own a split up, it’s possible your obligations (if 401k mortgage, borrowing bucks worthy of etcetera.) can just be considered independent obligations into the settlement, belonging to you in the place of reducing the marital concoction (come across opinion throughout the 401k solution over).

Needless to say, a monetary choice should never be generated without considering the book situation, given pros and cons, new much time- and you may short-term affects of behavior including borrowing from the bank, upcoming advancing years resources, the capability to payback personal debt to name a few, and having the fresh advice off compatible gurus. This is not meant to be monetary, income tax, or legal counsel, however, options for their thought and discretion.

Web log Disclaimer: The latest viewpoints expressed during these blogs was only new author’s and do not reflect brand new feedback and you can opinions of the Certitrek, IDFA or its affiliates.