If you find yourself a national employee, in which if you find financial help? The latest Service away from Houses and Metropolitan Advancement (HUD) also offers programs that will help purchase a home.

What exactly is HUD?

HUD are a federal government institution that provides construction assist with every People in the us. Especially, HUD will help people who lack higher incomes select a destination to alive.

Let is available in the type of local rental coupon codes and you may home loan insurance. Additionally, it include subsidized houses and partnerships having regional groups.

You ought to work on a beneficial HUD-recognized real estate professional for those who wade brand new station out of a good HUD system. Very real estate agents can meet that it standard, however it is best that you glance at basic.

How will you Qualify for HUD Apps?

Very HUD software address lower-income anyone. For many who meet the requirements, you could make use of this type of software. Several shelter leasing recommendations or personal housing.

Or even, seek out the fresh Federal Casing Government (FHA). Its an arm out of HUD that will help people who don’t see official certification for the majority out of HUD’s apps. If you’re an instructor, firefighter, or some other government staff, your s instead.

The next thing

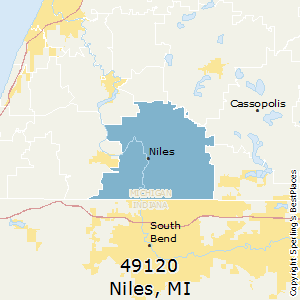

You s of the deciding to settle down within the elements which aren’t in demand. These could be metropolitan otherwise outlying section trying to find revitalization.

New National Houses Operate can make the fresh new designations for these portion. It takes into account factors such as for example income or foreclosures loans Sugarloaf occurrence into the a region. Additionally the available residential property tend to be way more affordable.

When you find yourself willing to go without located in the latest hottest city, that will convert so you can big offers. Areas having down incomes and much more quit domiciles makes this new HUD record. You’ll want to agree to residing in one of these areas for a few age, but not.

Check out Other Novel Programs that provide Affordable Property

If you are prepared to deal with a home that really needs particular love, the next apps may be right for you. You’ll need to do a bit of renovations. However you won’t have to fork out a lot for the top end of the home-to acquire procedure.

Will you be an excellent Neighbors Nearby?

Can you behave as an emergency scientific specialist, police officer, firefighter, otherwise k-a dozen teacher? The good Neighbors Next-door Conversion process Program would-be your homes answer.

Through this HUD system, you can buy 50% off the cost of a property in a qualified city. You only need to invest in living truth be told there to possess 36 months.

This type of section include underserved. You can easily see a listing of offered qualities inside additional states through the HUD site. Within the agreement, you will need to submit an additional home loan with the count of your own disregard. Providing you stay static in the house towards consented go out, you don’t need to make any costs inside.

All you need to carry out try complete the mandatory files. You could get good home in the a high write off!

Dollar House May help

Dollars Belongings is yet another HUD system worth exploring. Through this system, you are able to get a home having very little just like the $step 1!

The gist of program is simple. Home that will be coming in at $twenty five,000 or faster possess 6 months to stay in the market. If they do not promote for the reason that go out, the purchase price drops so you can $step 1.

These types of homes commonly precisely the fresh new construction, but they are an acquire. Regardless if you are a national employee looking to residential property a fixer-upper or a neighbor hood low-cash, such homes try a massive worthy of. Specific regional governments commonly genitals right up such residential property in order to serve reasonable-earnings members of its town.