- Leave strategy

- Borrower credit history

- Earnings

Collateral

Equity are a valuable asset a borrower offers to assuring a loan provider they receive the payment long lasting (ex: a property). In the event the debtor do not repay the loan unconditionally, the non-public lender is grab the asset. Equity must have a premier well worth that does not might depreciate throughout the years and stay an easy task to cash out into the if the it gets required.

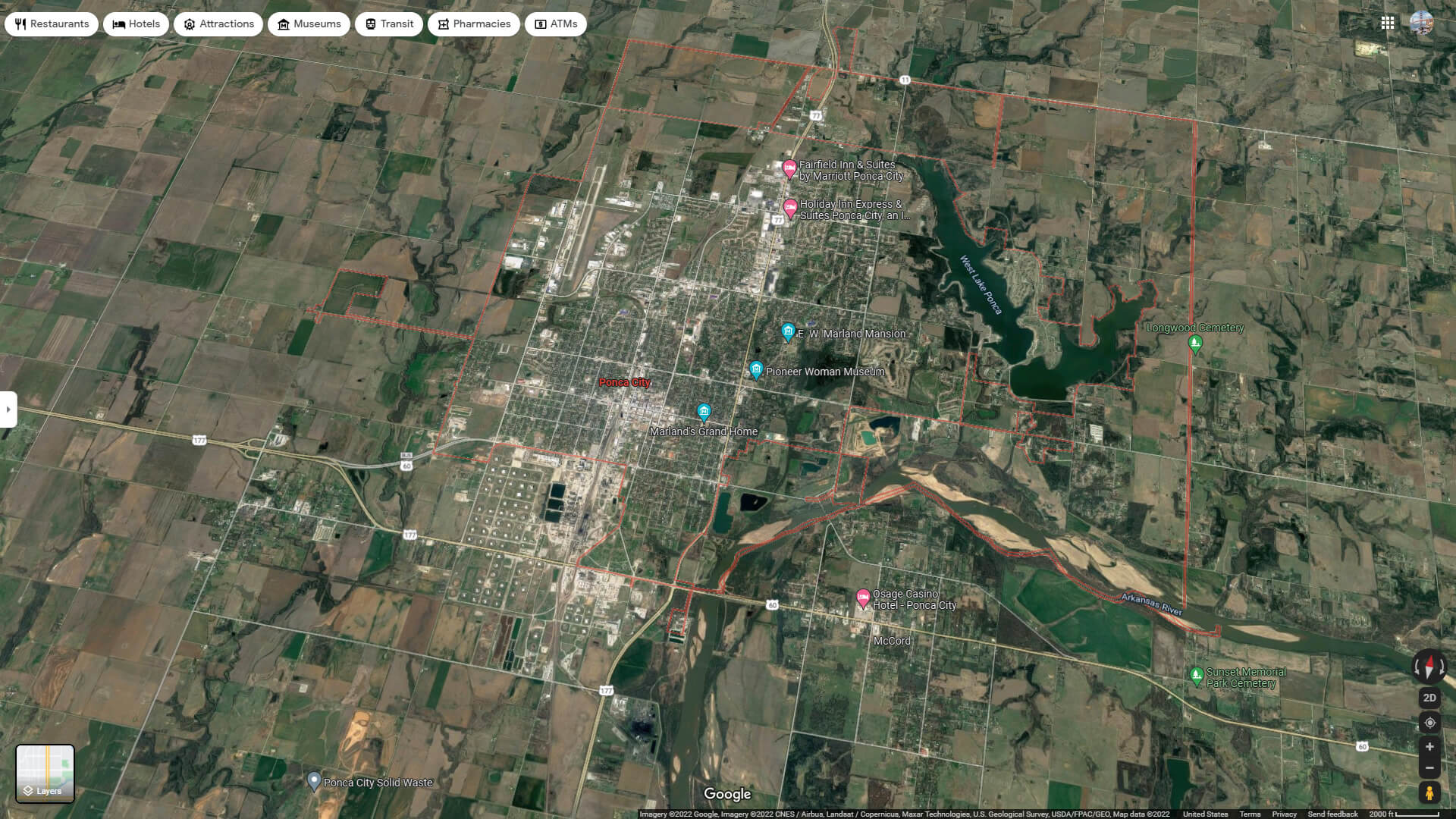

Private lenders for real property funding tend to lay their own variables to your kind of collateral they’re going to lend on the. Such as, some lenders only give towards residential assets, while other loan providers tend to lend to your commercial and you will residential property assets once the really. The location of the house along with takes on a role, as much lenders desire to work with specific markets (ex: Southern Florida).

Experience

If a genuine estate trader is simply starting out, it probably will not have of a lot achievements stories to show accuracy. If you are a new comer to the industry referring to very first day securing a personal loan, it won’t necessarily effect loan approval, you might possibly be up against high interest levels or even be expected to expend a higher downpayment than you expected. It is usually required to share your collection out of work at your lender or give them a corporate package, for them to get a better sense of their feel and/otherwise money method.

Get-off Approach

A property buyers have to have exit procedures. A leave strategy is a method to straight back off good a house deal if you’re (hopefully) dropping as little money to. Really private loan providers will demand one to have an escape method to repay the borrowed funds amount within maturity. Some traditional hop out measures certainly borrowers to have an exclusive financing become refinancing, securing a casing financing (to own unused homes), playing with money out-of a unique business, or attempting to sell the new advantage.

Borrower Borrowing

Individual mortgage approvals commonly credit history motivated, which means discover usually zero minimum FICO score requisite. But not, a private mortgage lender get pull their borrowing from the bank to be certain their credit rating does not let you know any current bankruptcies or foreclosure. So if a bona-fide estate trader does not have any a great credit rating, or no credit rating on U.S. whatsoever, but their financial reputation together with top-notch new advantage was voice, a loan that have an exclusive lender do remain an excellent choice for all of them.

Debtor Income

The good thing about personal lenders is because they will want less earnings records than antique fund away from a vintage financial. In place of asking for 2 yrs worth of tax statements, shell out stubs, and you can W2s, an exclusive lender may only request a copy of your newest bank statement that shows enough liquidity and cash circulate to pay for six-1 year interesting costs.

Techniques to Discuss Finest Financing Terms and conditions

Settlement takes on a crucial role during the field of individual lending. In the place of antique lenders, personal lenders will often have the flexibility to modify financing terms established with the individual items. Thus towards proper strategy, you might discuss most useful financing terms minimizing rates of interest one line up along with your economic specifications and you can financing means.

Developing a powerful experience of the financial can be a game-changer regarding discussing financing terminology. This does not mean Chatom loans only keeping a specialist rapport; it involves demonstrating their accuracy while the a borrower and your partnership into resource.

Typical interaction, fast money, and you can visibility about your financial predicament is also all of the sign up to a beneficial strong financial-debtor relationships. Lenders who faith the consumers are more likely to become versatile for the loan words.