- Not one.

Skills

The development of a beneficial $5,000 grant having qualified homeowners from the Ally Economic Inc. is short for a proper effort intended for exciting the fresh domestic home loan industry. By the concentrating on about three major town elements, Friend Home is probably pick a boost in financial software, that will produce a higher volume of loan originations. Which step also can help the organizations aggressive edge on financial credit market by drawing a generation that can was in fact prior to now sidelined due to economic limits.

Regarding an economic angle, the fresh new circulate might improve Ally’s share of the market and you may cash into the the borrowed funds segment. Although not, it is very important take into account the chance character of your own the fresh customer base that offer you are going to attract. There is a smooth balance ranging from broadening field arrived at and you can keeping loan high quality. Dealers is to display the new efficiency ones finance through the years to gauge the influence on Ally’s financing profile health.

The fresh collaboration having HouseCanary to enable users to easily choose offer-qualified services from Friend ComeHome look webpage is actually a noteworthy creativity in the a property technology area. This partnership leverages research analytics to improve our home-to get procedure, potentially enhancing the results and you can appeal of the new Ally system. On home ic ecosystem, with additional option of homeownership to possess customers who’re have a tendency to unaware of readily available financial help.

Although this effort you will increase homeownership prices, it can be crucial that you check out the potential for surrounding sector overheating when the consult notably outpaces likewise have. This might inadvertently join ascending home values from the targeted town areas. Housing market stakeholders is anticipate one signs and symptoms of such as for instance unintended effects, that will connect with casing cost in spite of the grant’s purpose to greatly help customers.

Ally Financial’s move to give homebuyer features is seen due to the fact a financial stimulus on microeconomic peak. From the expanding accessibility to homeownership, there might be a ripple effect one to benefits the brand new large economy. Homeownership is frequently from the enhanced consumer spending considering the relevant sales and renovations one to this new homeowners generally generate.

Although not, the fresh new enough time-term financial feeling commonly mainly believe new sustainability of your provides system and its particular capacity to measure in the place of leading to an boost in default costs. On top of that, the result on the larger housing marketplace, and additionally potential inflationary pressures in the targeted components, is going to be very carefully reviewed. Brand new step you will definitely offer an important example into effectiveness of focused financial help throughout the housing marketplace.

Ally House Offer will be visible for the lender’s household research portal; a market-disruptive disperse enabled by the HouseCanary to produce assistance much more obtainable and homeownership much more achievable for more consumers

CHARLOTTE, N.C. , /PRNewswire/ — Ally Economic Inc. (NYSE: ALLY) today launched one Friend House, the home-based mortgage lending case of Ally Financial, will offer a good $5,000 offer getting qualified homeowners inside the around three significant town portion so you’re able to use to your downpayment, closing and other costs. To simply help people take advantage of this assistance, Friend is actually partnering with HouseCanary to add users with devices to help you without difficulty pick grant-qualified features via the Ally ComeHome research site.

Having that-3rd away from U.S. customers clueless one to grants or any other aid come, rather than once you understand enough in the assistance programs being the main reason people give getting perhaps not obtaining any, that it scratches the first occasion an electronic digital-merely lender has actually given instance a simple solution.

“The newest homebuying procedure was daunting enough without the added complexity regarding distinguishing and protecting the help you may need to pay for good family to start with,” said Glenn Brunker, Chairman out of Friend House. “To the service out of HouseCanary’s technology potential, the audience is removing such difficulties by making a single-stop-shop with the gadgets, resources and items a beneficial homebuyer demands in their whole travel.”

“Leveraging creative technical to help with customers during their homeownership travel are main in order to HouseCanary’s purpose. By incorporating the ComeHome tech on Ally’s site, we’re stocking Ally’s users that have a user-friendly program that produces looking give-eligible characteristics an easy and successful processes,” told you Jeremy Sicklick, Co-Founder and you may President in the HouseCanary.

Promoting its objective to shut persistent homeownership holes when you find yourself riding regional monetary progress, the Ally House Grant could well be available to home owners within the come across avenues with a full time income below or equivalent to

of town average earnings (AMI) and for the acquisition of a first household. People who qualify can be combine the new Friend Household Give with increased gives or choices out of Ally, such as the Fannie mae HomeReady Mortgage system, that enables people to be people to own as little as

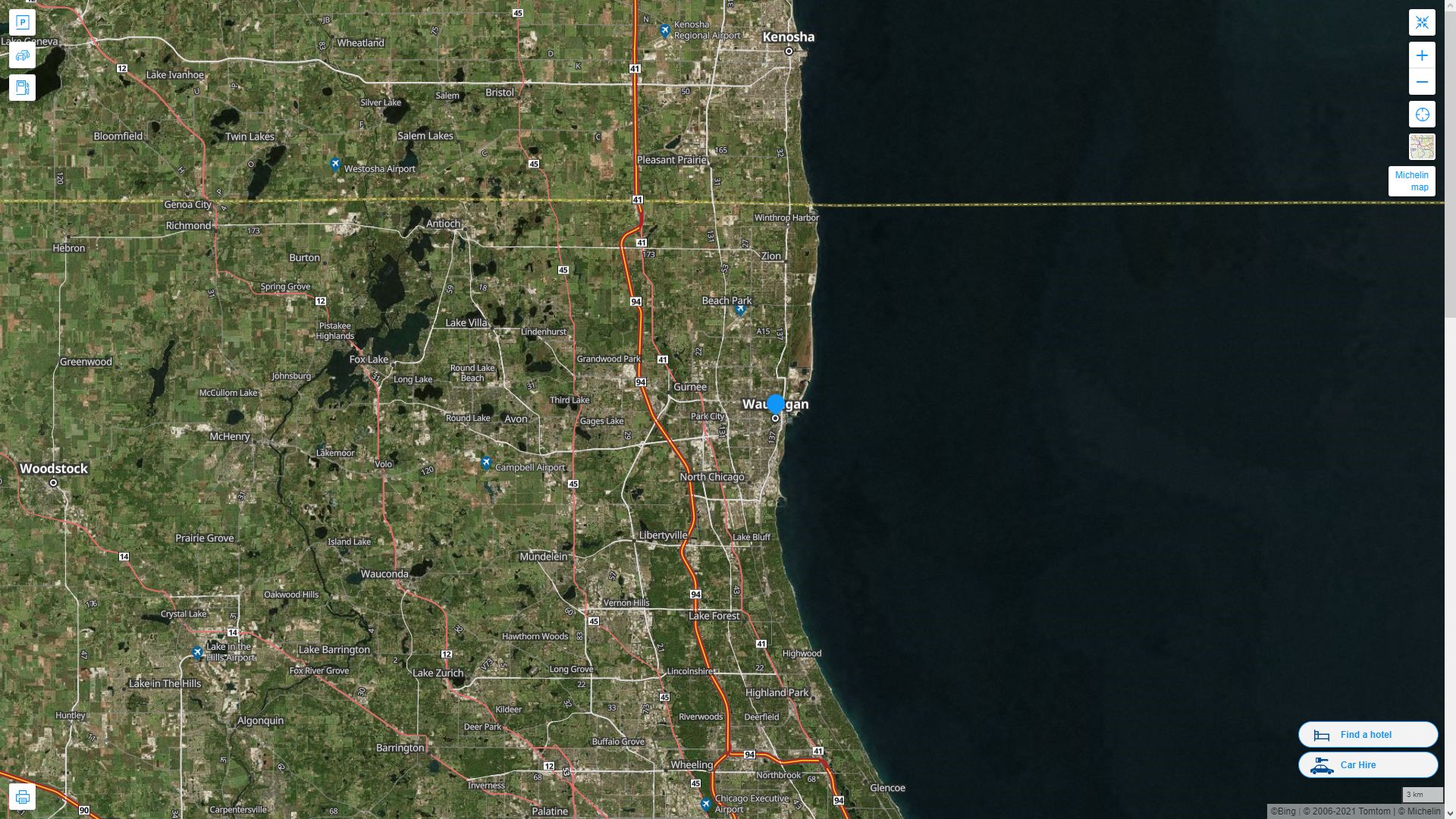

down. Brand new has might possibly be available to homeowners inside the Charlotte , Detroit and Philadelphia inside look for segments that have idea to grow inside the near future.

“To shop for a house is a keen unattainable fantasy for over 1 / 2 of out of You.S. residents, for this reason we strive while making homeownership a lot more accessible to a larger a number of some one and you can group,” said Brunker. “Because of the bridging the brand new affordability gap and you will reducing the burden of initial will set you back of buying, the features will assist more people discover its dream about becoming a resident it is able to go into the industry, generate collateral and construct generational wide range.”

For the late 2023, Friend launched their ComeHome program in concert with HouseCanary which will make a powerful home travel environment that have possessions search equipment to own prospective homebuyers and title loans in IN you may home valuation info to have current home owners. Since that time, the working platform provides obtained 53,000 active pages and you may is growing.

Friend Lender Releases Domestic Give Program Near to New Qualification Lookup Equipment

Friend Financial Inc. (NYSE: ALLY) is a financial features organization towards nation’s largest every-digital lender and you will a market-leading auto resource providers, inspired of the a purpose in order to “Still do it” and become a relentless ally to possess users and you will groups. The firm serves whenever 11 mil consumers due to a complete diversity from on the internet banking attributes (also places, mortgage, and you will mastercard facts) and you will bonds broker and you will investment advisory features. The company also incorporates a robust business loans organization that provides financial support for security sponsors and you will center-market enterprises, and vehicle capital and you can insurance coverage products. To find out more, please visit friend.

Founded within the 2013, national home broker HouseCanary empowers customers, creditors, people, and you can lenders, that have globe-best characteristics and valuations, predicts, and you may deals. These types of customers believe HouseCanary in order to electricity order, underwriting, portfolio management, and more. Learn more on housecanary.

If you find yourself currently dealing with an agent, it is not intended since the a beneficial solicitation of the providers.

HouseCanary, Inc. is actually an authorized Real estate Brokerage in KS, NM, Sc and under the Exchange Title ComeHome within the AL, AK, AZ, California, CO, CT, DC, De-, Florida, GA, Hi, IA, ID, IL, Inside the, KY, La, MA, MD, Me, MO, MN, MS, MT, NC, ND, NE, NH, Nj-new jersey, NV, Nyc, OH, Ok, Otherwise, PA, RI, SD, TN, Tx, Va, VT, WA, WI, WV, WY.

AVM Disclosure: An AVM is a projected income speed getting a house. This isn’t similar to the fresh thoughts of value during the an assessment created by a licensed appraiser beneath the Consistent Requirements regarding Top-notch Appraisal Routine.