Regarding the financial banking landscaping, area reinvestment tasks are crucial in fostering fair lending techniques and you will creating economic growth in underserved areas. The city Reinvestment Work (CRA) functions as a cornerstone in this procedure, encouraging loan providers in order to meet the credit means of your organizations in which they operate. Maximizing CRA credit try a regulatory demands and you may a strategic chance to have mortgage lenders to show the commitment to people development and you will expand their field come to.

Skills CRA Loans

From the their center, the city Reinvestment Act aims to address disparities for the the means to access credit and you may financial services certainly one of reasonable-and average-money organizations and you will communities out of colour. The CRA tries so you can turn on economic progress, would perform, and you will provide reasonable housing effort of the promising banking companies or other financial organizations to find these types of organizations.

Creditors secure CRA loans because of individuals things leading to neighborhood invention, and additionally home loan financing, small company financing, society invention financing, and you can expenditures in the reasonable houses plans. These credits are essential to possess banking companies to show compliance which have CRA guidelines and can surely impression its abilities recommendations by regulating agencies.

HLP’s FaaS Solutions for Improving CRA Loans

Home Lending Pal (HLP) now offers innovative solutions employing Equity Due to the fact A support (FaaS) platform, which is made to help lenders improve their CRA credit steps and you will improve the people reinvestment operate.

Breakdown of HLP’s Earliest Look CRA Equipment

HLP’s Basic Look CRA tool will bring loan providers with an intensive analysis of their financing portfolio, distinguishing loans that can be eligible for CRA credits in accordance with the geographic delivery out of individuals. Because of the leveraging research analytics and you can consolidation with established Customer Matchmaking Management (CRM) or Loan Origination Possibilities (LOS), lenders reference can efficiently select opportunities to maximize its CRA credits while ensuring conformity with fair lending guidelines.

Addition to HLP’s 2nd Look Dash

Including identifying CRA-eligible finance, HLP’s 2nd Lookup dashboard now offers information to the other businesses, including downpayment advice and you may very first-time homebuyer apps, that can then assistance community advancement effort. By streamlining the whole process of determining and you may helping varied people, loan providers can expand accessibility homeownership solutions and you will subscribe to exciting underserved teams.

Caring and you may Storage which have HLP’s White-Branded Software

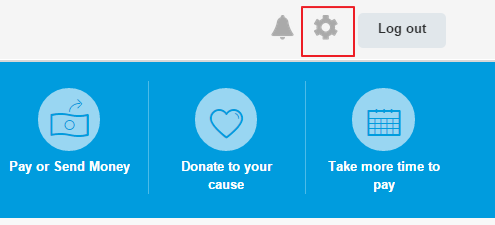

HLP’s light-branded application was a powerful equipment getting entertaining and you may caring possible consumers who might require additional time is ready to pertain getting a home loan. As a result of enjoys such as for example domestic searching, to acquire power calculation, borrowing from the bank improving, and you will financial obligation-to-income proportion formula, borrowers usually takes hands-on tips with the homeownership. At the same time, lenders get valuable knowledge with the competition and you can ethnicity styles. Of the caring matchmaking with your individuals, loan providers can increase their tube away from varied borrowers and you may improve their community reinvestment work.

Managed Functions for Directed Post Strategies

HLP now offers treated services to own think and you can executing directed ad tricks for lenders trying boost the level of diverse candidates. Because of the leverage studies analytics and you may markets wisdom, lenders can also be efficiently reach underserved groups and you will attention potential borrowers exactly who may be eligible for CRA credits. Outsourced deals work so you can HLP allows lenders to focus on the core company items if you find yourself enhancing their impact on people advancement.

Tips for Boosting CRA Credits

- Need HLP’s products to help you improve CRA compliance processes and you may pick opportunities to have boosting CRA credits.

- Control research understanding to help you effectively target underserved organizations and you will personalize marketing work to satisfy their needs.

- Incorporate CRA credit optimization on the complete team methods, aligning neighborhood reinvestment work having organizational goals and objectives.

To close out, enhancing CRA credit isn’t only a regulating requirements and also a strategic imperative having mortgage brokers trying to have indicated the union in order to neighborhood innovation and you can fair credit practices. Because of the leverage imaginative options like HLP’s FaaS program, lenders normally improve their CRA compliance procedure, expand entry to homeownership ventures, and you may contribute to the economic energies out-of underserved organizations. Even as we seek out the continuing future of mortgage financial, optimizing community reinvestment work will continue to be necessary for riding renewable development and you will cultivating inclusive success.

Speak about just how HLP’s FaaS selection may help the facilities maximize CRA credit and you can improve society reinvestment work. Contact us today to learn more about our creative gadgets and you will managed features having mortgage lenders.