Questions regarding the brand new FHA system conditions or pre-approval? In order to facilitate your own request easily, delight complete the latest short advice demand mode in this post, 7 days a week.

If you are looking to help you refinance a different sort of mortgage loans including Virtual assistant, USDA, or Antique, delight complete the information and knowledge Request Form more resources for refinancing choice.

On this page

- What is a keen FHA refinance mortgage?

- As to why submit an application for a great FHA re-finance?

- Why does an enthusiastic FHA refinance loan really works?

- Who qualifies for FHA re-finance?

- Types of FHA refinances funds

- FHA Cash-out Re-finance

- FHA (Federal Construction Administration) Improve Re-finance

What is a keen FHA refinance mortgage?

The brand new FHA financing system has been very popular than before the newest recent years while the borrowing from the bank happens to be harder to obtain. FHA fund are among the most useful possibilities for borrowers who does want to re-finance the mortgage to find a much better offer or perhaps to pay personal debt. FHA fund are called a straightforward loan so you can meet the requirements due into versatile borrowing recommendations therefore the lowest guarantee criteria. Taking FHA finance was common for homebuyers who have been as a result of a monetary credit experiences such a short purchases, foreclosures or any other monetaray hardship across the longevity of the mortgage previously and so are looking to get its cash back on course.

Why apply for good FHA refinance?

FHA refinance apps are made to help borrowers with current FHA finance straight down the month-to-month mortgage payments otherwise accessibility security in their land. Here are some reasons why you can imagine obtaining an FHA re-finance:

Straight down Rates of interest: One of the primary reasons to refinance a keen FHA loan is for taking advantage of straight down interest rates. In the event that field rates of interest keeps dropped because you first obtained your own FHA loan, refinancing helps you safer a special financing having a reduced interest rate, potentially cutting your monthly premiums.

https://clickcashadvance.com/personal-loans-wi/

Smaller Monthly obligations: Of the refinancing the FHA financing, you might be capable expand the borrowed funds title, ultimately causing lower month-to-month mortgage repayments. This really is specifically of use if you’re facing financial demands otherwise have to improve your income.

Convert of Varying Rate to help you Fixed Speed: If you have an FHA adjustable-rates financial (ARM) as they are concerned about ascending interest levels, you can refinance to help you a predetermined-price FHA financing to add stability on your own monthly premiums.

Cash-Out Re-finance: FHA has the benefit of bucks-away refinance alternatives, allowing you to utilize your residence collateral. This can be used for and make renovations, paying down highest-appeal loans, otherwise layer extreme expenditures, like studies otherwise medical expense.

Improve Refinance: The newest FHA Streamline Re-finance program is actually a simplistic procedure built to ensure it is easier for existing FHA consumers so you can refinance their finance. It needs reduced records and can always be finished with minimal borrowing from the bank and you may assessment requirements, therefore it is a handy selection for the individuals trying to lower the interest levels or monthly premiums.

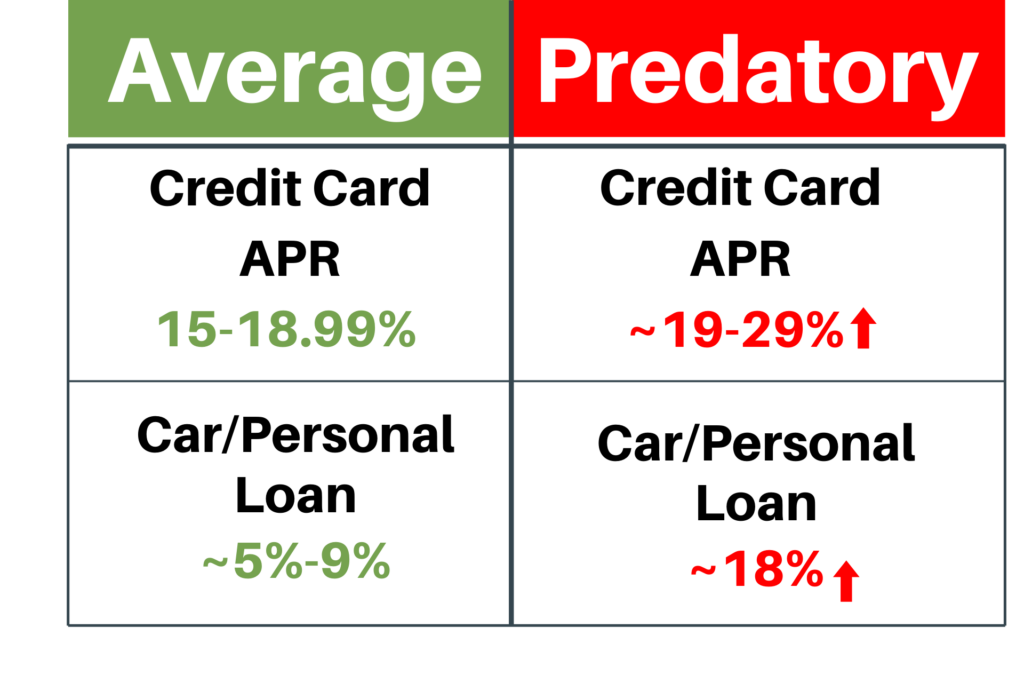

Debt consolidation: When you have large-notice bills, such bank card balance otherwise signature loans, you can make use of an FHA cash-away refinance to help you consolidate such debts to your an individual, lower-desire financial, probably helping you save money.

Financial Advanced Protection: Depending on when you first acquired your own FHA mortgage, the loan insurance fees (MIP) you only pay is generally greater than the present day costs. Refinancing the FHA financing get allow you to decrease your MIP money.

Do it yourself: FHA also provides 203(k) recovery finance which can be used to invest in renovations whenever your re-finance. This will be such as helpful if you would like get good fixer-top while making required repairs otherwise enhancements.